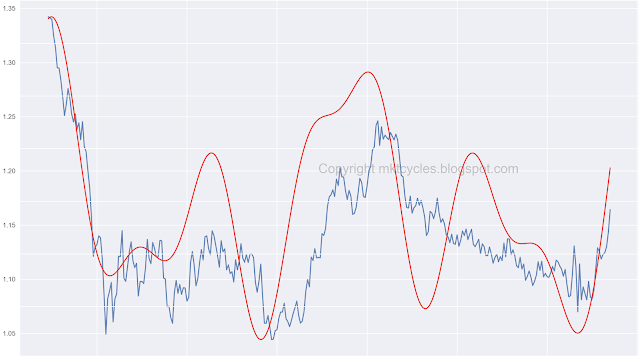

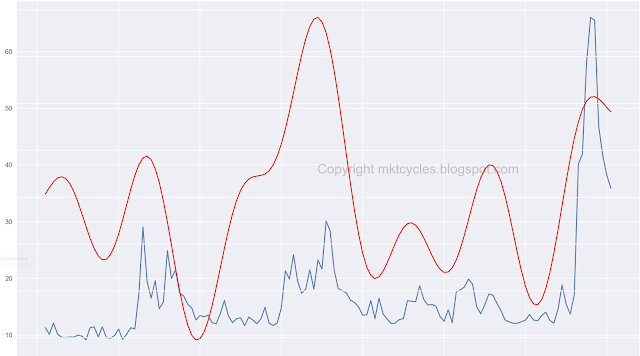

Bitcoin price data shows very consistent cycles that have helped keep our subscribers on the right side of the market. As an example, the below two daily and weekly cycle charts predicted the recent medium-term bottom and the following enormous 50+% gain in price. If you would like to subscribe to our regular Bitcoin update service then reach out to us at the Contact Us page.

|

| Bitcoin Daily Cycles - 11/08/2020 |

|

| Bitcoin Weekly Cycles - 11/08/2020 |